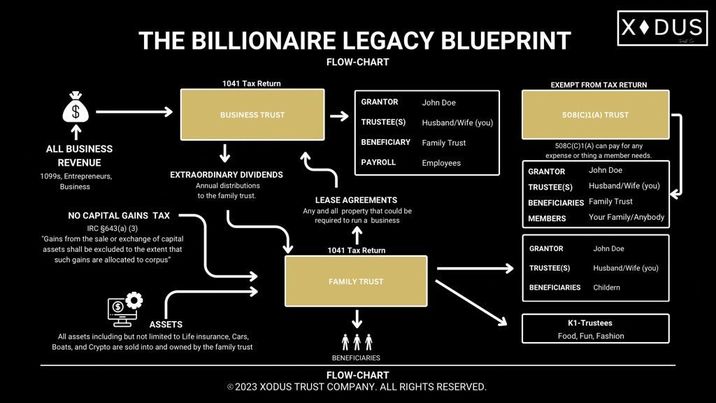

THE BILLIONAIRE LEGACY BLUEPRINT

Key features of our trusts…

At Xodus, we believe in true American freedom—the freedom to protect your wealth, secure your legacy, and live life on your own terms

01

Non-Grantor

Our trusts are established as Non-Grantor trusts, meaning that once the trust is set up, the grantor relinquishes all control and benefits associated with it. By ensuring that the grantor is neither a beneficiary nor a trustee, we eliminate the risk of the trust being considered an alter ego of the grantor. This structure provides a robust layer of protection against any legal challenges or claims that might attempt to pierce the trust.

02

Non-Statutory

Our trusts operate under the common law, independent of statutory regulations that typically govern more conventional trust structures. This non-statutory nature means the trust adheres to centuries-old principles of contract and trust law, offering a level of flexibility and privacy that statutory trusts cannot match. This framework ensures that the trust is protected from governmental overreach and remains a private arrangement between the parties involved.

03

Irrevocable

An irrevocable trust is one that cannot be altered, amended, or revoked after its creation. This permanence is key to its strength, providing the grantor with peace of mind that the assets within the trust are shielded from future claims, creditors, and estate taxes. The irrevocability of our trusts ensures that once assets are transferred, they are effectively removed from the grantor’s estate, offering substantial protection and tax advantages.

04

Discretionary

Our trusts are discretionary, meaning the trustee has the full authority to decide when and how distributions are made to beneficiaries. This flexibility allows the trustee to manage the trust in a way that best suits the needs of the beneficiaries while ensuring compliance with the trust’s terms. It also protects the trust from any claims that could arise from beneficiaries demanding distributions, as the trustee’s decisions are final and cannot be contested.

05

Complex

Unlike simple trusts that must distribute all income annually, our trusts are complex. This means they have the ability to retain income, distribute principal, or direct income to charity, all at the discretion of the trustee. This complexity allows for greater control over the trust’s operations, optimizing tax outcomes and ensuring the trust can adapt to the changing needs of its beneficiaries.

06

Spendthrift

A spendthrift provision is a crucial feature of our trusts, safeguarding the trust’s assets from creditors of the beneficiaries. With this provision in place, beneficiaries cannot sell, pledge, or otherwise transfer their interest in the trust before receiving distributions. This protects the trust’s assets from being claimed by third parties, ensuring that the assets remain secure and are used solely for the intended purposes of the trust.