PROTECT YOUR ASSETS, STRATEGICALLY MITIGATE TAXES, AND SHAPE YOUR LEGACY WITH XODUS TRUST CO.

The Mission of Xodus Trust Co.

At Xodus Trust Co, we’ve identified a widespread gap in financial understanding among many Americans, especially concerning the capabilities and mechanics of properly structured irrevocable trusts. Our research shows that 94% of our clients lack a clear understanding of how trusts function. This gap signifies not just a lack of knowledge but a barrier to effectively utilizing trust structures for financial prosperity.

Our mission is focused on education and clarity, aimed at unraveling the complexities of tax codes and trust laws that have traditionally been accessible only to the wealthy. Leveraging over thirty-five years of combined experience, we have revamped an already revolutionary trust system. This system draws inspiration from strategies originally pioneered by the Rockefellers, tailored to meet the needs of today’s families and entrepreneurs.

Keep More of What You Earn

Minimize Your Tax Burden

Do high taxes on your income leave you searching for relief? The relentless bite of taxation can diminish the wealth you've diligently accumulated, leaving less for savings, investments, or personal enjoyment. At Xodus Trust Co., we specialize in deploying sophisticated tax strategies designed to significantly reduce or, in some cases, entirely eliminate your tax obligations. Our aim is to help you retain more of your hard-earned money, enabling you to grow your wealth with minimal financial interference.

Protect Your Assets

Are you concerned about the security of your assets in the face of lawsuits, creditors, or financial downturns? Without stringent protection, your wealth could be exposed to risks that threaten to erode what you've built. The fear of asset loss can be stressful, especially when standard protections fall short. Xodus Trust Co. offers premier asset protection services, ensuring that your wealth is securely guarded against any potential threats, preserving your financial foundation against all odds.

Create a Lasting Legacy

Are you anxious about how your wealth will serve future generations? Without a strategic plan, the legacy you envision may falter, potentially jeopardizing your family’s future and the fulfillment of your long-term goals. At Xodus Trust Co., we assist you in developing a robust legacy plan that protects your values and wealth, ensuring that your vision has a lasting impact and continues to benefit your descendants for generations.

Become Your Own Bank

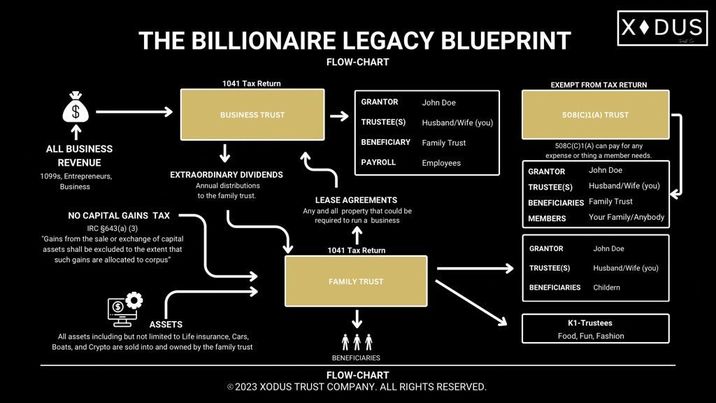

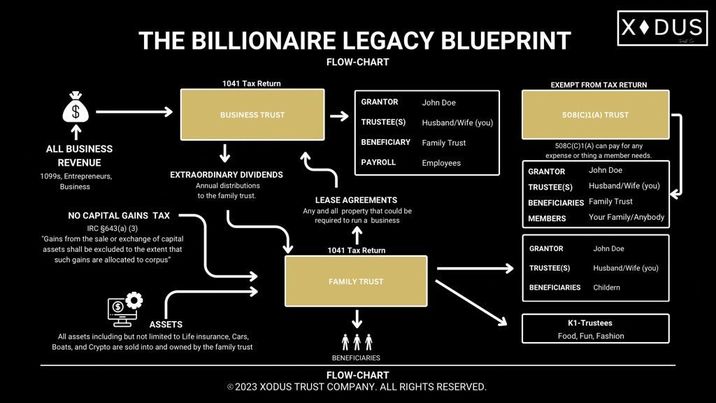

What is the Xodus Billionaire Legacy Blueprint?

The Xodus Billionaire Legacy Blueprint is more than a mere financial strategy; it’s a holistic system crafted for profound wealth management, asset protection, and legacy construction. This blueprint is inspired by the same principles that have safeguarded the fortunes of the world’s wealthiest dynasties, utilizing the time-honored Rockefeller method to perpetuate and enhance wealth through generations.

At the heart of the Xodus Billionaire Legacy Blueprint is a commitment to shielding your wealth from overbearing taxation, legal uncertainties, and undue government scrutiny. We hold that excessive taxation is an undue burden, and our aim is to help you legally minimize this, preserving more of your wealth. Through the use of sophisticated trust structures and life insurance, this blueprint is engineered to fortify your assets and cultivate a lasting legacy.

Our blueprint starts with establishing custom trust arrangements that robustly protect your assets. These trusts are designed to shield your wealth from legal and tax-related threats, ensuring your financial legacy remains untouched for your descendants.

We incorporate state-of-the-art asset protection tactics to secure your wealth against potential legal threats such as lawsuits and creditors. Using strategies pioneered by the Rockefeller family, we guarantee the security and continuity of your assets, come what may.

The blueprint employs the Rockefeller method’s principles for strategic wealth accumulation, focusing on enhancing your financial base while mitigating risks. This involves diversifying your investment portfolio, refining your financial structures, and fostering continual growth of your assets through fluctuating economic landscapes.

The Xodus Billionaire Legacy Blueprint ensures that your legacy will thrive beyond your lifetime. By integrating life insurance as a pivotal financial instrument, we establish a durable financial safeguard for your family, ensuring wealth transfer is managed in a tax-efficient manner that reflects your long-term aspirations.

A cornerstone of our blueprint is the effective reduction of your tax liabilities. Employing advanced tax planning and trust techniques, we assist you in significantly lowering—or even eliminating—the taxes that could otherwise diminish your wealth. This strategy empowers you to conserve more of your earnings, allowing for strategic reinvestments that secure a flourishing future for your lineage.

THE BILLIONAIRE LEGACY BLUEPRINT

FLOW-CHART

2024 XODUS TRUST COMPANY. ALL RIGHT RESERVED

Key features of our trusts

At Xodus, we believe in true American freedom—the freedom to protect your wealth, secure your legacy, and live life on your own terms

Our trusts are established as Non-Grantor trusts, meaning that once the trust is set up, the grantor relinquishes all control and benefits associated with it. By ensuring that the grantor is neither a beneficiary nor a trustee, we eliminate the risk of the trust being considered an alter ego of the grantor. This structure provides a robust layer of protection against any legal challenges or claims that might attempt to pierce the trust.

Our trusts operate under common law, independent of statutory regulations that typically govern more conventional trust structures. This non-statutory nature means the trust adheres to centuries-old principles of contract and trust law, offering a level of flexibility and privacy that statutory trusts cannot match. This framework ensures that the trust is protected from governmental overreach and remains a private arrangement between the parties involved.

An irrevocable trust is one that cannot be altered, amended, or revoked after its creation. This permanence is key to its strength, providing the grantor with peace of mind that the assets within the trust are shielded from future claims, creditors, and estate taxes. The irrevocability of our trusts ensures that once assets are transferred, they are effectively removed from the grantor’s estate, offering substantial protection and tax advantages.

Our trusts are discretionary, meaning the trustee has the full authority to decide when and how distributions are made to beneficiaries. This flexibility allows the trustee to manage the trust in a way that best suits the needs of the beneficiaries while ensuring compliance with the trust’s terms. It also protects the trust from any claims that could arise from beneficiaries demanding distributions, as the trustee’s decisions are final and cannot be contested.

Unlike simple trusts that must distribute all income annually, our trusts are complex. This means they have the ability to retain income, distribute principal, or direct income to charity, all at the discretion of the trustee. This complexity allows for greater control over the trust’s operations, optimizing tax outcomes and ensuring the trust can adapt to the changing needs of its beneficiaries.

A spendthrift provision is a crucial feature of our trusts, safeguarding the trust’s assets from creditors of the beneficiaries. With this provision in place, beneficiaries cannot sell, pledge, or otherwise transfer their interest in the trust before receiving distributions. This protects the trust’s assets from being claimed by third parties, ensuring that the assets remain secure and are used solely for the intended purposes of the trust.